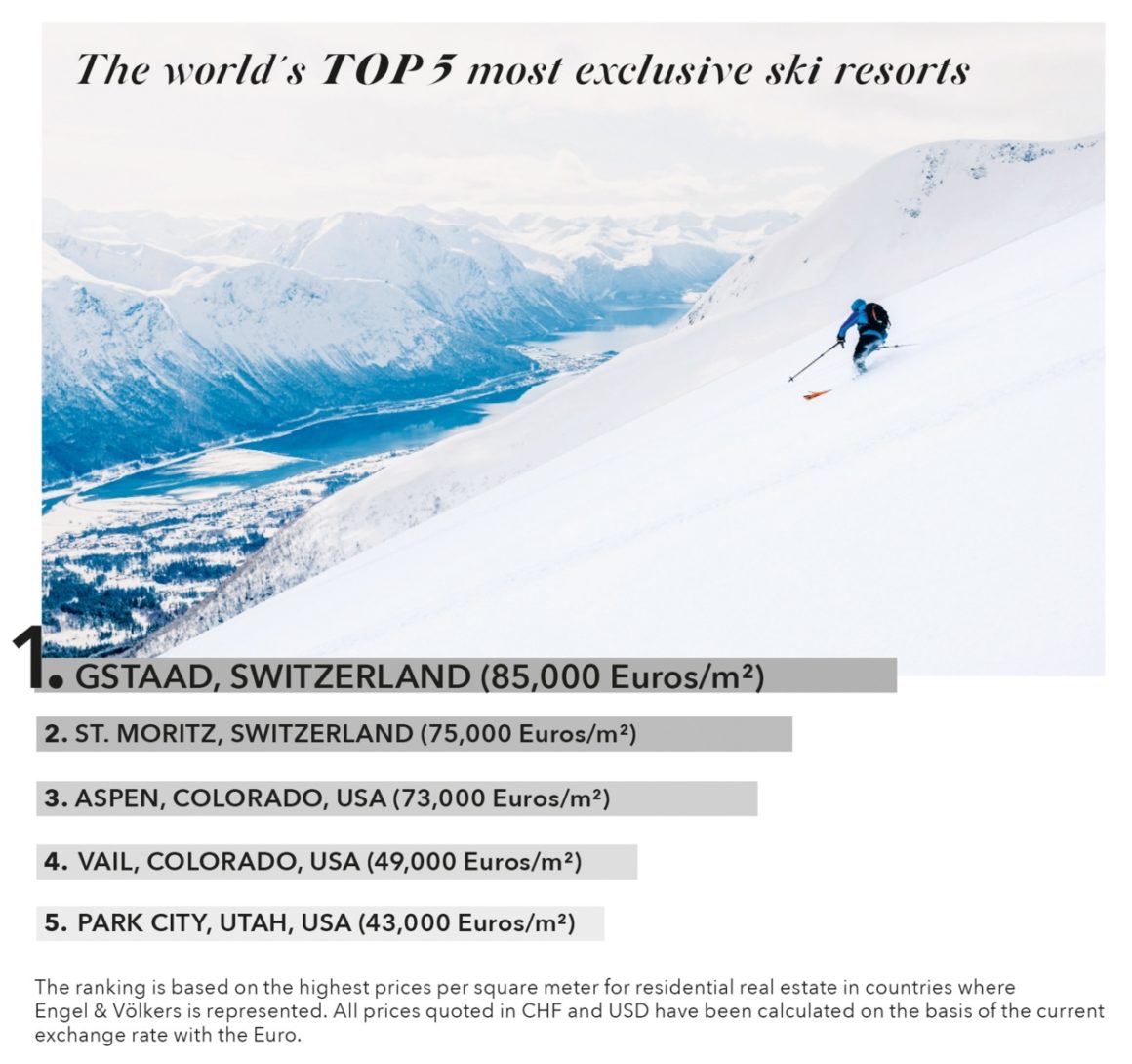

The world’s most coveted ski destinations according to the Engel & Völkers Ski Ranking 2026

As global wealth continues to gravitate toward tangible lifestyle assets, ski real estate is entering a new golden era. According to the Engel & Völkers Ski Ranking 2026, Switzerland and the United States dominate the world’s most exclusive alpine property markets, with destinations such as Gstaad, Saint-Moritz, and Aspen firmly leading the global ranking.

What drives this renewed demand is not only snow reliability or prestige, but a broader shift in how affluent buyers define value: heritage, discretion, lifestyle longevity, and scarcity.

Ski property as multigenerational capital

Across the Swiss Alps, ski real estate has long been perceived as a form of cultural capital. In markets such as Gstaad and Saint-Moritz, properties often remain within the same families for generations, managed by private family offices and rarely entering the open market.

Strict regulations, including Switzerland’s Lex Weber law limiting second homes and foreign ownership, further restrict supply. As a result, demand structurally exceeds availability, pushing prime prices in Gstaad beyond €85,000 per square metre, and up to €75,000 per square metre in Saint-Moritz.

For international buyers, these destinations offer something increasingly rare: privacy, political stability, and long-term value preservation embedded in a refined alpine lifestyle.

The American Alps: lifestyle-driven ski real estate

In the United States, ski real estate tells a slightly different but equally compelling story. Resorts such as Aspen, Vail, and Park City appeal to high-net-worth individuals seeking a balance between outdoor performance and year-round lifestyle.

Aspen remains the crown jewel of the Rockies, with prime real estate reaching up to €73,000 per square metre. Beyond its legendary Champagne Powder snow, the town offers private aviation access, Michelin-level dining, wellness facilities, and a cultural calendar that rivals global capitals.

Vail attracts buyers with its European-inspired alpine architecture, refined gastronomy, and modern infrastructure, while Park City has emerged as a fast-rising destination combining ski-in ski-out properties with a lively historic downtown and direct access to the largest interconnected ski area in the United States.

Scarcity as the new luxury

A defining characteristic across all top-ranked destinations is scarcity. Construction limitations, environmental protection, and zoning regulations severely constrain new developments. In Aspen, strict building rules and limited land availability reinforce long-term price stability. In Switzerland, canton-specific ownership rules continue to restrict foreign access, making trophy assets increasingly rare.

According to Engel & Völkers, this imbalance between demand and supply will continue to support stable to rising prices in 2026 and beyond, particularly for properties with direct slope access, panoramic views, and architectural distinction.

Living well beyond the slopes

Today’s ski buyers are not just purchasing winter retreats. They are investing in year-round ecosystems built around wellness, gastronomy, culture, and nature. Easy access to hiking, cycling, spa culture, fine dining, and cultural events has become just as important as proximity to ski lifts.

This evolution explains why destinations like Aspen and Park City attract buyers from tech, finance, and creative industries, while Swiss resorts continue to appeal to families seeking discretion, tradition, and legacy.

A glimpse inside exceptional alpine living

Engel & Völkers currently represents an exceptional private residence in Aspen, offered at USD 24.5 million. The property combines contemporary wood and stone architecture with spa-level amenities, including a sauna, ice bath, multiple fireplaces, and panoramic terraces overlooking pristine nature.

In Saint-Moritz, an exclusive duplex penthouse offers refined chalet-style interiors, expansive glazing, and valley views, just minutes from the resort’s glamorous centre. These properties illustrate how alpine living has evolved into a sophisticated design and lifestyle statement.

Looking ahead to 2026

As global investors increasingly prioritise real assets that combine emotional value with long-term stability, alpine ski real estate is poised to remain one of the most resilient lifestyle investments. Whether driven by heritage preservation in Switzerland or lifestyle optimisation in the United States, the mountains continue to represent a rare intersection of beauty, privacy, and enduring value.